Cash is your short term friend and equities are your best long term friend. Inflation however, is your worst enemy.

Given what is currently going on in the world, and the various ‘expert’ predictions, we at TWP believe it is always important to get back to basics.

Firstly cash is your friend, but in our view only for the short term. We believe, and recommend having a pot of money that is always held in cash to meet short term objectives, and by the short term we typically mean a period up to 3 years. This pot of cash should be there to meet any income or capital expenditure needs over this period, and is simply for that purpose. It is not intended to deliver double digit growth, and in the current interest rate environment it certainly will not do this, it is there to remove investment risk and provide those funds for the short term needs.

Now we will have all heard the saying cash is king, and we certainly believe that to be true for a pot of money needed for short term needs. However over the long term holding cash is a problem due to the enemy that is inflation. Indeed since the Great Financial Crash holding cash would have actually lost you money.

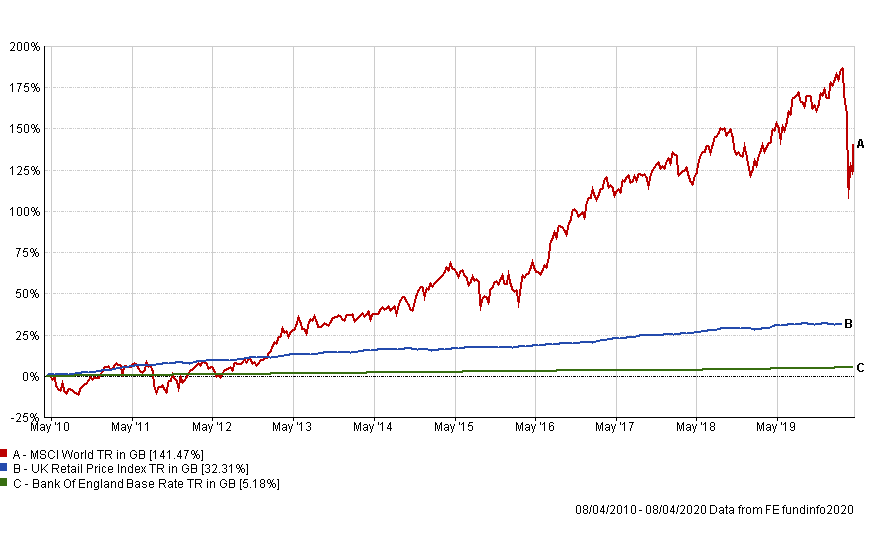

Over the long term therefore you need to turn to you best friend – equities. The chart below demonstrates the returns of the MSCI World Index over the last 10 years compared to the UK retail price index and the Bank of England base rate.

This chart backs up the point that since the Great Financial Crash holding cash would have lost you money in real terms, as it failed to keep up with inflation (UK RPI). Perhaps more importantly what this chart also highlights is the returns you would have missed out on by not investing a portion of funds in equities. Even taking into account the recent market falls you would still have been better off over the last 10 years in equities compared to simply holding cash.

In addition you may have heard, or read about people talking about selling out funds to cash and waiting till the bottom of the market, and then going back into the markets. The first thing we would say on this, is if someone can time when markets are at the bottom, then they have a crystal ball and can predict the future. Know any individuals who can do this, thought not.

Secondly let’s take the month of April as an example. If as an example you were invested in the FTSE100 at the end of March and decided to sell to cash, then you would have missed out on the second best FTSE100 April performance in a decade. Therefore in selling to cash you would have missed out on the returns from April.

Need a further reason why cash is not your long term friend, how about this example. Draught lager cost about £3.20 per pint in 2012, now I don’t know about you but the price for a pint of lager in the local pub near our office is north of £4 (in fact quite a bit north). Or how about this, a Mars bar in 2009 cost around 35p. The current cost is around 65p – and may I add you are getting less chocolate these days! What does this mean? Well simply that £3.20 you had in cash in 2012 is not going to be buying you a pint now.

In very simple terms by not having a portion of your savings invested in asset classes which generate a return over and above inflation in the long term, equities for example, then you are facing a risk to your capital, which is inflation eroding the value of these savings. Inflation destroys the purchasing power of money, and holding all your funds in cash is one sure way to lose money over time.

Whilst we are living in strange times, and yes equities are more volatile then cash, we still firmly believe that cash is your short term friend but equities are your best long term friend, and remember inflation is your long term enemy.

Fancy a chat or even a Zoom, please get in touch: 01625 582500 or enquiries@TWPWealth.com

‘The Dead Cat Bounce’

‘The Dead Cat Bounce’